In the Know

Rate Cuts? Who Needs Rate Cuts?

Good Day,

In the ever-evolving dance of global financial markets, a curious phenomenon has taken center stage - the enigma of rate cuts. Despite denials from European Central Bank President Lagarde and Federal Reserve Chair Powell, markets continue to swirl with speculation. The Stoxx Europe 600 Index even made history by crossing the 500 level for the first time, leaving us to ponder: Who needs rate cuts, anyway?

As we embarked on this new year, optimism was fueled by the expectation of central banks launching an aggressive rate-cutting spree. However, the reality seems to be drifting away from those initial projections. The Federal Reserve signaled three rate cuts, yet none has materialized. Similar echoes resonate in Europe, where initial expectations have dwindled from four to three cuts.

Central bankers leave the door ajar, hinting at potential cuts later in the year. Commentators are quick to predict a June cut, with markets pricing in a staggering 93% probability for such an event. The Federal Open Market Committee (FOMC) meeting looms, and the probability for a June cut hovers at 95%. Yet, amidst this speculative fervor, the question arises: Are rate cuts even necessary?

Consider the robust state of the US economy - GDP comfortably hovering around 3%, nonfarm productivity matching estimates, and unit labor costs showing resilience. Pre-market futures rally, seemingly unaffected by the Federal Reserve's quantitative tightening efforts. Equities remain unfazed by the shrinkage in the Fed's balance sheet.

One can't help but wonder: Why cut rates when the economy is thriving, productivity is high, and employment levels are strong? Is the prospect of rate cuts being dangled like a carrot in front of Investors, or do central banks see something we don't?

A compelling argument emerges for the counterintuitive benefits of higher rates. As interest rates rise, so does income for baby boomers and retirees, injecting a disguised form of economic stimulus. Picture a retiree earning 5% interest on $1 million compared to a meager 2%. This increase in income may well be contributing to sustained consumer spending, a lifeline for the US GDP.

And as we explore this complex financial terrain, let's not forget the real estate market, a realm held hostage by high rates. Discouraging homeowners from selling and relinquishing their low-rate mortgages, the real estate market supply is artificially kept low, effectively establishing a price floor beneath values. The reduction in rates in the foreseeable future might unveil the true value of the possibly overinflated real estate market. Brace yourselves, for it might not be a pretty sight when homebuyers' loan payment abilities meet sellers' price expectations.

In the intricate dance of global markets, the story of rate cuts unfolds as a captivating mystery. Are they a necessity or a tantalizing allure for investors? As we navigate these uncertain waters, one thing becomes clear: The financial world is a stage, and the drama of rate cuts, coupled with the real estate market's secrets, adds another layer of intrigue to the script.

Stay tuned, dear readers, for the unfolding chapters in the captivating saga of global finance.

Wishing you all an enlightend weekend!

Warm regards,

Alexander

P.S.

DID YOU KNOW? California is the most populous US state, home to Hollywood, Silicon Valley and a real estate market worth more than $9 trillion.... (Bloomberg)

DID YOU KNOW? 120,000 of the world’s millionaires moved to a new country in 2023, up from 84,000 in 2022 and expected to rise to 128,000 in 2024. The top 5 destinations for high-net-worth individual migration were Australia, the United Arab Emirates, Singapore, the U.S. and Switzerland. China, India, the U.K., Russia and Brazil lead the ranking of countries with the most people leaving. (Henley)

DID YOU KNOW? Chicago is proceeding with a revamp of empty downtown office buildings initially estimated at $1 billion in an effort to counter a commercial real estate crisis that’s cut office sale prices by more than 50%. Adding new home inventory via conversions is part of the great rebalancing in all things real estate. (Bloomberg)

DID YOU KNOW? Since COVID, Doctors have been charging for emails, up to $35 per email, and rightfully so. Their time is valuable. Thankfully I have been reimbursed for the many hours I have waited past my appointment time. Oh, just kidding! Thankfully real estate agents often don't get paid for emails. Or texts. Or calls. Or tours, or......?

DID YOU KNOW? In 2014, the total net worth of US households was $82.6 TRILLION: today it has nearly doubled to $151 Trillion, up from $117 trillion at the end of 2019 prior to COVID. By the end of 2020, the first year of the COVID surge, net worth had escalated to $131 trillion, up almost 12% in one year! Much of that has to do with rising home values and equity gains.

“The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,”

DID YOU KNOW? New tax policies in the UK: they will abolish the non-domiciled tax status. Non-dom status enables someone who lives in the U.K. but is not settled in the country permanently to only pay U.K. tax on money made in the country, and to avoid paying it on foreign income. National Insurance, a tax on payrolled workers, will be cut from 10% to 8%, furthering the previous cut in November from 12% to 10%. The average earner in the U.K. now has the lowest effective tax rate since 1975, now lower than in America, France, Germany or any G7 country, according to government officials.... (CNBC)

DID YOU KNOW? Annual Ozempic in the US costs about 10 times what it does in Britain, Australia or France. In Denmark - the home country of Ozempic producer Novo Nordisk - the cost of the drug is under $3,500 a year, roughly 25% of the US..... THIN-flation??

DID YOU KNOW? Can you even believe that before 1974, women often were not permitted to obtain a mortgage without a male cosigner. The Equal Credit Opportunity Act (ECOA) of 1974 was a turning point for women in America and their financial futures. Before the ECOA, women generally could not take out loans without a male co-signer, and lenders often saddled female borrowers with higher interest rates and larger down payment requirements. We have come a long way! Today, women actually outpace men in homeownership. (Bankrate)

DID YOU KNOW? J P Morgan private banking thinks there are going to be bumps along the way, but that central bankers have the ammunition needed to win the fight against inflation. The labor market continues to rebalance alongside still-solid growth. More foreign born workers and women are re-entering the labor force, alongside the allure of work-from-home postings. (almost 50% of new jobs added last year were remote or hybrid) This has helped wage growth cool with minimal economic pain to date. Without rate cuts, though, further disinflation means real rates would continue to push higher and run the risk of overtightening. While rate cuts may be less urgent than previously thought, they’re still on the way.

NEW—Technical Analysis

This Week’s Forecast Update — U.S. 10-Year Treasury Yields

Dive into the future with my new free Technical Analysis category, where I project the course of the S&P 500, the U.S. 10-Year Treasury Yields and the EUR/USD exchange rates using the Elliot Wave principle and Fibonacci price and time techniques. Understanding the upcoming price cycle is not just crucial for investors; it's a game-changer for real estate and capital market enthusiasts alike. Explore the analysis for exclusive insights that could shape your investment strategies. Click [here] to delve into the latest projections now!

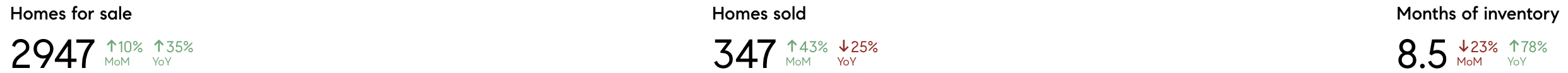

Single Family Homes for Sale in Collier County

Prestigious New Listings

6196 Megans Bay Dr, Naples, FL 34113

4 Bed | 3.5 Bath | $3,500,000

Discover luxury living in this Isles of Collier Preserve gem! Impeccably crafted through Stock Construction, this home harmonizes elegance with nature. Entertain seamlessly in the open living space with high ceilings and a gourmet kitchen featuring top-tier appliances. Step into your private oasis - a screened lanai overlooking lush landscapes, a dazzling lake view, and a refreshing pool and spa. Master suite indulgence with spa-like amenities and walk-in closets. Additional bedrooms and a dedicated home office cater to family needs. Outside, embrace Naples living with a clubhouse, walking trails, and fitness facilities. Isles of Collier Preserve offers a lifestyle defined by nature's beauty. Your dream home awaits, showcasing tranquility and sophistication.

6002 Barthelemy Ave, Naples, FL 34113

3 Bed | 3 Bath | $2,695,000

Embrace luxury coastal living in this beautifully appointed move-in ready home in prestigious Isles of Collier Preserve. The Jasmine Grande floor features an expansive lanai with custom saltwater pool and spa, and marble pavers where you can enjoy a sunny southern exposure and sparkling lake views. The open floor plan seamlessly blends the indoor and outdoor spaces. The Isles of Collier Preserve amenities include miles of recreational paths, the Overlook Bar and Grill, resort-style pool, fitness center, tennis and pickleball, and a full activity schedule.

6582 Amarone Ln, Naples, FL 34113

3.5 Bed | 3 Bath | $1,597,000

Welcome to your dream home in the prestigious guard gated Lakoya at Lely Resort! This meticulously maintained exquisite lakefront property offers unparalleled privacy and elegance. Boasting a spacious popular open flowing Tivoli III model with 3 bedrooms plus den and 3 full baths, the open floor plan is perfect for both entertaining and everyday living. Residents of Lakoya at Lely Resort have immediate access to the exclusive Player's Club & Spa, offering a variety of social and sporting activities, including tennis, pickle-ball, bocce, and resort-style pools. With three championship 18-hole golf courses nearby, this is resort-style living at its finest. Don't miss your chance to own this meticulously maintained and highly updated home in one of Naples' most sought-after communities.

5901 Berwick Ln, Ave Maria, FL 34142

4 Bed | 3 Bath | $699,000

Exceptional opportunity to own in The National Golf and Country Club at Ave Maria! Newly built in 2022, this Maria Model IS THE LOWEST PRICED MARIA RESALE AND INCLUDES GOLF MEMBERSHIP! The home features 4 bedrooms, 3 full baths, over 2247 sqft of living space, a heated pool with spa and water/golf views! National amenities are due to be completed soon and will include a 23,000 sqft clubhouse, two restaurants, state of the art fitness center, full-service Spa, resort pool and a lap pool. Plus, the Gordon Lewis designed golf course, 8 tennis and 6 pickleball courts and 2 pro shops. The Ave Maria community has a lot to offer including: parks, walking trails, restaurants, shopping, Publix grocery and so much more!

Featured Global Listings

1 Bed | 1 Bath | $5,000,000

Experience peace and solitude from sunrise to sunset at this Upcountry Maui sanctuary. At the end of the road on the aptly named Easy Street lies meticulously kept gated farm acreage that’s a true sensory delight. Overlooking vast Ulupalakua Ranch lands, out here you’re one with nature, stargazing at night from the open-air soaking tub and waking each morning to the gentle bird songs. There’s an ever-changing visual palette throughout each day from sunrise pastels to striking mid-day blues over the south shore open ocean and outer-island views to the vibrant warmth of sunset. The farm dwellings are beautifully appointed with high-quality finishes. Open-beam ceilings and large windows welcome loads of natural light and maximize views. Large ipe lanais complement each home for a seamless indoor-outdoor flow. Photovoltaic panels power the property along with Fiber Optic Internet and serviced by a 3/4-inch county water meter.

228 Benchmark Dr, Mountain Village, CO 81435

5.5 Bed | 6.5 Bath | $15,950,000

Featured in Architectural Digest for its exceptional design & interior spaces, this mountain Arts & Crafts-styled home offers a timelessly Telluride look & feel. Located trailside on two ski-in/ out lots, this 5-bdrm custom residence & attached caretakers quarters offers nearly 11,000 gross sq ft of usable area. With a series of warm spaces framed dramatically by scissor-trusses finished in hand-hewn quarter-sawn oak & mahogany, the floors, trim & paneling give the home a rich & enduring feel, while marble, copper & custom tiles give each bath their own distinctive feel.

The Luxury Division

Your Fairway to Fortune

Your tee time is approaching, so get ready to dive into the world of luxury living with Compass agents in Northeast Florida as they share exclusive insights and trends from the region's prestigious golf course communities. In celebration of TPC Sawgrass, top agents reveal the latest market insights and trends while offering a sneak peek into some of the most coveted properties nestled within these sought-after neighborhoods. Get ready to explore unparalleled elegance and sophistication in Northeast Florida's premier golf course enclaves.

Architecture + Design

See you next time.

Broker Associate at COMPASS Naples

Serving Naples, Miami, Sarasota, Atlanta, New York, San Francisco, Los Angeles, Chicago